In today’s travel market, payment collection and processing are no longer simply about “collecting money.” Travel agencies process orders daily from diverse countries and currencies: some are large payments made months in advance, while others are last-minute air or hotel reservations. Without a professional travel industry payment system, payment processing can become the biggest bottleneck slowing down business growth.

Why do Travel Agencies Need a Professional Payment System?

Risks of Large Prepayments

Travel payment collection and processing often involves prepayment. Many customers are prone to plan changes, flight cancellations, or refunds before their trip, making travel payment processing more challenging and making the travel industry considered high-risk.

Flexible Payment Methods

Deposit + final payment, installment payments, and instant payments—each travel agency’s payment collection methods vary. Not all payment platforms are compatible with these travel payment processes.

Cross-Border and Multi-Currency Demands

Travelers from different regions may use credit cards, e-wallets, and local payment methods simultaneously. Without multi-currency travel payment support, travel agencies face high fees and exchange rate risks.

High Chargeback Rates

High chargeback rates are almost universal in the travel industry. Some are due to service interruptions, while others are due to “friendly fraud.” Without a suitable travel payment processing mechanism, profits and merchant account security are directly impacted.

Increased Fraud Risk

High unit prices combined with high turnover rates make travel agencies attractive targets for fraudsters. The lack of AI-based verification and risk monitoring systems can exacerbate losses.

Travelconnect: A New Travel Payment Solution

To address the challenges faced by travel agencies and online travel platforms, we offer a peer-to-peer payment solution designed specifically for growing travel businesses, helping partners maintain competitiveness in the global market.

Multi-Currency Travel Payment

Supporting multiple major currencies and offering transparent and competitive exchange rates, travel agencies can reduce exchange costs and improve international transaction efficiency.

Peer-to-Peer Payment System

Enables customer payments to be paid directly to merchant accounts, shortening settlement cycles and eliminating intermediaries, ensuring secure and efficient capital flows.

Intelligent Risk Control and Security Compliance

All payments comply with PCI-DSS international standards and utilize AI-powered risk identification to reduce the risk of chargebacks and fraud, ensuring the security of travel agency operations.

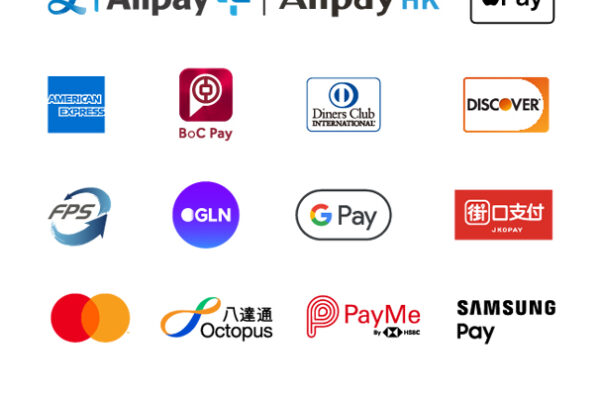

Comprehensive Payment Method Integration

- Credit and Debit Cards: Supports global card schemes like Visa and Mastercard, meeting the needs of high-value bookings and handling large-scale transactions with a stable system.。

- QR Code and Local Payments:Supports popular local payment methods like AlipayHK, WeChat Pay, Octopus, and PayMe, enhancing customer convenience.

Optimizing Travel Payment Processes

Our payment gateway supports:

- Online checkout (e-commerce payments)

- POS (physical payment collection)

- Payment settlement with global suppliers, airlines, and hotels

The entire travel payment process, from front-end customer payment to back-end partner settlement, can be completed on a single platform, significantly improving efficiency.

Zero Application Fee, Zero Annual Fee, and Ultra-Fast Settlement!

| Payment Methods | Handling Fee | Fixed Fee | Settlement Time | |

|---|---|---|---|---|

| Online Payment | Visa / Master | 2% | HKD $1.5 | T+5 / T+10 |

| Overseas | 3.8% | HKD $1.5 | ||

| Alipay | 1.6% | Exempt | ||

| Offline Payment | Visa / Master / UnionPay | 1.5% | Exempt | T+2 |

| Alipay / WeChat Pay | 1.2% | |||

| Octopus | 1.5% | |||

| PayMe | 1.1% |

References

A Game-Changer for the Travel Industry

TravelConnect ties all the dots of the travel industry and empowers the travel companies by unifying and modernising existing outdated and fragmented technologies